Impact of Covid19 on group insurance/pricing

Two words: Pandemic fatigue! These two words describe how many of us feel following a year of regulations, lockdown, illness and stress. It is a collective mind-set of struggle and toil. And why not? After all, we have all lived the uncertainty, we have all experienced loss, and we all continue to live with the grief… and the fear. It is a dread we are constantly, verbally and physically, reminded of every time we put on (or remove) our masks, every time someone greets us with the elbow, every time a stranger asks us to sanitise our hands. So it is not surprising that South Africans are tired of it.

The fatigue probably hit its peak during November and early-December 2020 when it was palpable; almost tangible. At the time, the “pandemic fatigue” phrase (or some variation thereof) was heard often. People were tired of adhering to the sometimes senseless regulations and the seemingly misdirected enforcement of these, and it was also the much anticipated festive season. December is traditionally the time for South Africans to relax, unwind and spend time with loved ones. It is not a time to isolate, wear masks and social distance … or so we thought.

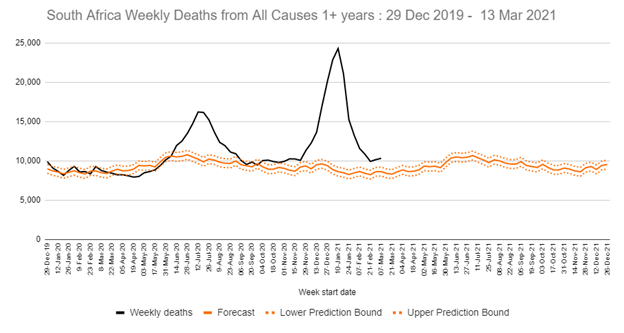

After the shock of the first wave (from June to August 2020), South Africa experienced our second wave between late-November to early-February. The South African Medical Research Council’s statistics on weekly deaths (see Figure 1 below) shows how deaths peaked during mid-January, at almost the same time as the UK and USA third wave peaks. The global “January peak” also hugely exceeded any prior Covid-19 wave experience and has been attributed to the factors mentioned above – increased socialising during the festive season and the pandemic fatigue, as well as the introduction of a virulent new strain locally.

Figure 1: SAMRC weekly death statistics showing the peaks during Covid-19 wave periods

In the 45 weeks from 3 May 2020 to 13 March 2021, South Africa recorded about 148 000 excess deaths with the majority of these likely being attributable to Covid-19. The 148 000 excess deaths amount to about 35% more deaths than South Africa would normally experience over the same period (about 420 000).

These deaths severely impacted the insurance industry, with all the large insurers reporting significant increases in claims during this period. Sanlam Group Risk, being the largest provider of death benefits in the market, has similarly experienced excess mortality with claim patterns that mirror the national experience. Worryingly, the industry is warning of more to come with current projections that South Africa can expect at least two more waves before the effects of the vaccine and population immunity are realized. Some modelled scenarios indicate that mortality could double on average for the foreseeable future.

While Sanlam is not expecting a doubling of general mortality rates, the modelling as well as the experience in recent months does suggest that the cost of human lives – the lives of family, friends and colleagues – will continue to be devastating.

However, it is not only the humanitarian cost but also the financial cost that weighs heavily on employees. The economic effects of the virus are well-documented and include increasing unemployment, salary reductions, salary freezes, etc. These also come with an increased burden on the employed population, many of whom must now provide for additional family members or cope with reduced family incomes.

To aggravate the situation, the high claim rates has now reached a point where group risk premium rate increases are unavoidable. Feedback we receive from our clients is that “the entire market has shifted”, which indicates that the increased premiums are already further reducing disposal incomes and intensifying members’ financial strain.

Despite this, the higher and rising premium rates will not last forever. Normality will return, be it through the vaccination or population immunity. The deaths will subside, the economy will recover, and financial pressures will be overcome. Until then, we take solace from knowing that the benefits offered by group insurance providers continue to make a meaningful difference in the lives of the far-too-many who have already suffered tragic loss, and will continue to do so for others in their time of need.

We also take hope from the resilience of the South African people who have already endured so much and overcame so many challenges. We encourage each and every person not to succumb to the insidious beast called “pandemic fatigue”, but to energetically fight against it until we can once again return to living normally.

Warm regards,

Reinier van Gijsen