Managing group insurance costs

There is currently a narrative in South Africa that group insurance premiums are increasing to the point that they are becoming unaffordable for many employers and employees. In order to address the challenge, it is important to understand the reasons for these premium increases, and the probability of them increasing further in the near future.

Let’s keep in mind that, although some stakeholders have raised their concerns that insurers are being opportunistic, regulations strictly prohibit this. In terms of Section 46 of the Insurance Act, insurance premiums must be proportionate to the risk that they cover, and in terms of the Policyholder Protection Rules, insurance premiums must reasonably balance the interests of all the stakeholders and cannot recoup past losses. Furthermore, the commoditised, and intermediated nature of annually renewable group risk products ensure that market pressures prevent excessive margins. As a result, premiums are constantly reset and “matched” by the market to fair and reasonable levels.

The impact of Covid

By mid-2020, experts and insurers predicted that, in South Africa vaccines and population immunity would constrain the impact of future Covid waves. Instead, prior to the fifth wave, the number of cases in each wave peaked higher than the previous one, largely due to each wave being driven by its own Covid variant (with the second and third waves being the most severe).

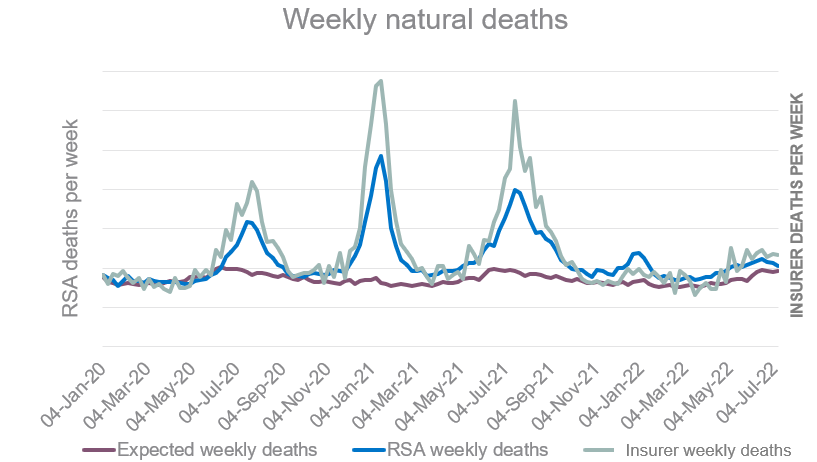

The graph below reflects the South African Medical Research Council’s expected versus actual weekly deaths, with the actual mortality claims of Sanlam Group Risk superimposed (on the right axis), displaying a remarkably similar pattern.

*85% to 95% of all excess deaths are estimated to be Covid-related

During the Covid waves, mortality claims peaked at over 300% of expected claims, and between waves claims were at least 15% higher than expected or pre-Covid levels. It is therefore not surprising that the 2020/2021 financial statements of major insurers reported that claims exceeded premiums by billions of rands.

These shortfalls reflect that positive bias impacted premium setting decisions early in the pandemic. In recent months however, the increase in underlying risk factors and the many uncertainties related to Covid have resulted in premiums increasing far more substantially.

As of late, the reduced Covid risks (off-set somewhat by increased other mortality causes) have resulted in group insurers’ pricing models decreasing group risk mortality premiums for future policy periods. The good news is, that with ongoing good mortality claims experience, together with the market factors mentioned earlier, policyholder can expect further mortality premium decreases.

Unfortunately, in contrast to the mortality experience, disability experience seems to be deteriorating rapidly.

The start of the pandemic saw insurers experiencing lower disability claims (i.e. income and lump sum) following years of deteriorating experience, which some hypothesised was exacerbated by the tax change in 2015 when disability income benefits became tax free. The temporary reprieve was attributed to the “paternal approach” of employers during the pandemic, where employers made additional efforts to accommodate disabled employees at the workplace or enabled them to work from home where they were more comfortable.

In 2021 as the economy and workplaces returned to the “new normal”, the claims incidents reverted to pre-Covid levels. In 2022 the claims incidents deteriorated by a further 30%-40%, with some of the increase attributed to the pandemic, where delayed and deferred treatments resulted in claims for medical conditions and non-communicable diseases.

Dr Jack van Zyl (Chief Medical Officer for Sanlam Corporate), has commented that he has certainly seen cases of long Covid and secondary Covid effects (e.g. cardiovascular, respiratory, Alzheimer’s, liver, weight gain and psychological conditions), but has also seen the flare up of other auto immune diseases like rheumatoid arthritis. He is concerned that because of the huge dependency on state care, and waiting lists for orthopaedic operations, any hope of rehabilitation is more limited than ever. Also, in the case of cancer treatment, which saw a 75% decrease in screening during the six strict lock-down months of Covid, medical aids hinder rehabilitation by limiting amounts available for care – all of these contributing to increased claims. Some of these incidents could have been avoided with the right treatment or interventions.

Options to manage disability insurance costs

In addition to the Covid related impacts, the state of the economy has a major impact on disability insurance claims, where some employers facing economic pressures use medical boarding as an alternative to retrenchment or performance management. The state of the economy has placed additional pressure on members, as they are now facing additional work-related stressors and increased feelings of helplessness, made worse by Eskom, violence and politics.

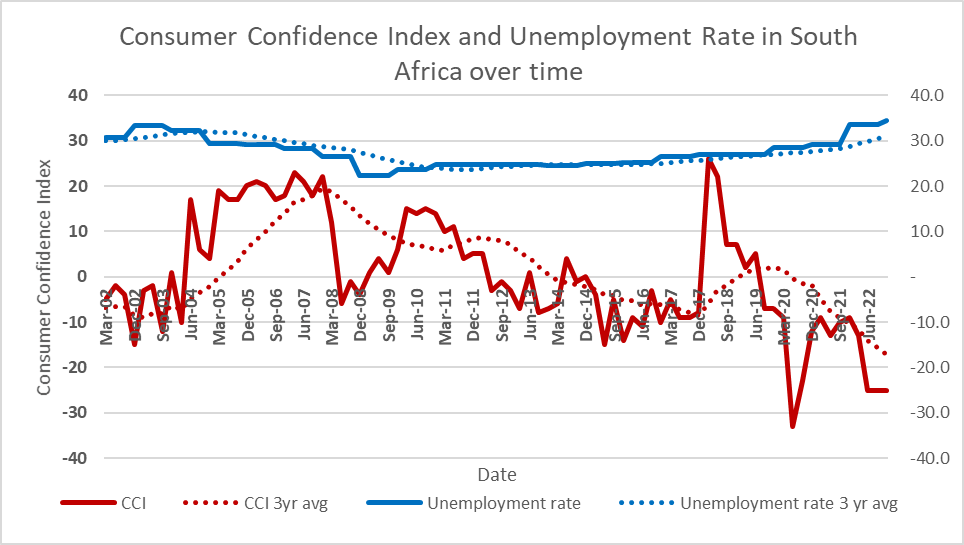

An actuarial model presented by Karl Shriek and Paul Lewis in 2010, hypothesized that there is a correlation between the state of the economy and disability claims. Through their modelling and analysis, they established that in the short to medium term:

- A 1.7% increase in the unemployment rate will lead to a 10% increase in disability claim incidents,

- A 10-point decrease in Consumer Confidence Index will lead to a 10% increase in disability claim incidents.

The graph above reflects recent statistics from SA Economics, which indicates that the unemployment rate has increased from 28% to 34% since early 2020, and the Consumer Confidence Index has decreased from -10 to -25 points. Using these factors, the model projects a 55% increase in disability claim incidents.

In 2018, Sanlam Group Risk attempted to retrofit this model to its claims experience, and at the time the model proved to be an adequate predictor of claims. Although it is probably not appropriate in a post-pandemic economy, the 40% increase in incidents referred to earlier does support the model’s key principle that disability insurance claims increase when the economy is weak.

To remain sustainable, insurers must ensure that their products remain affordable for policyholders, and pricing for these projected increases in disability claims is not going to achieve this. Other options to manage disability insurance costs include benefit restructuring, restrictions, and stricter underwriting conditions – for example introducing longer waiting periods, capping free cover limits and forward cover increases.

None of these options are beneficial to the policyholders, nor to the insurers, so alternative approaches are urgently required. Although explored in the past, it is only recently that incredible advances in technology have enabled the convergence between health and group risk insurance.

The goal is to offer scalable, proactive and engaging lifestyle interventions to improve the outcomes across multiple disease types thereby reducing hospitalisations and claims. Through technology and health data aggregation, health and group risk insurers can integrate and collaborate to prevent claims rather than price for claims. The advanced technology platforms and mobile technology can support meaningful relationships with members regarding their health, wellness lifestyle, mental well-being and even adherence to chronic disease management.

The improved claims experience for both health and life insurers, as well as the improved productivity for employers and most significantly the improved health of members, will be the most effective approach to reducing the costs of insurance in the future.

Warm regards,

Michele