The importance of group life insurance for employees was clearly highlighted during the Covid-19 pandemic. Most, if not all South Africans were impacted in some way by the unfortunate passing away of family members, relatives, colleagues, or friends after contracting Covid-19.

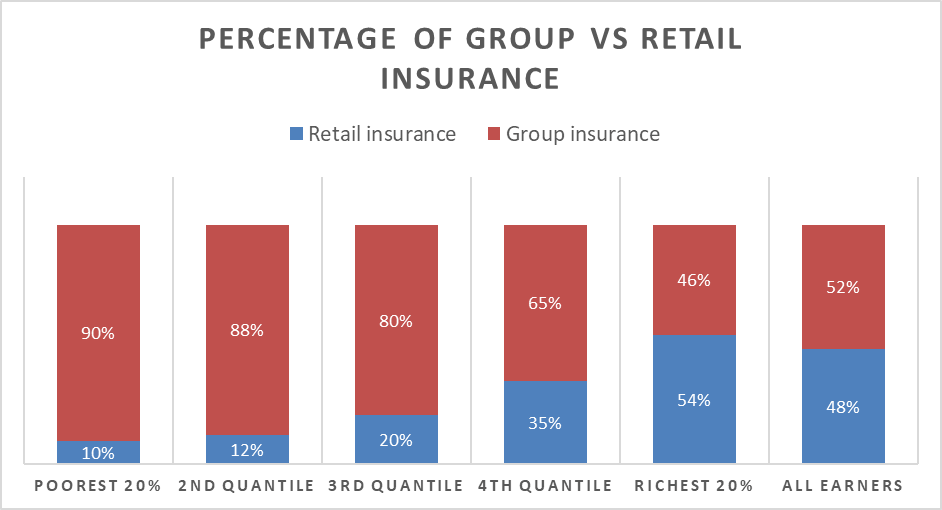

According to the 2019 Insurance Gap Study published by ASISA and True South Consultants, 52% of all life and disability insurance provided to South African employees were in terms of group insurance policies. Given that many employees, particularly those in the lower salary brackets, do not have any other life insurance policies in place besides the group insurance policy through their employer or retirement fund, their families would have been left in dire circumstances, if not for the safety net that their group insurance provided.

If one however looks only at lower earning employees (in the first, second and third quantiles of the graph below), then this number increases drastically to between 80% and 90% of employees’ life and disability insurance cover being provided under group insurance policies. Only about 19% (on average) of the life and disability insurance cover for these lower earning employees are provided under retail policies.

Anyone who has been responsible for arranging a loved one’s funeral will understand that quick access to the necessary funds is critically important for payment of the funeral service providers and other funeral-related expenses. Group funeral insurance is therefore of particular importance to many employees, as it provides the family with an almost immediate lump sum pay-out (normally within 48 hours after the insurer received the required claim documents), in the event of their death or one of their immediate family members.

Without the employee’s funeral benefit pay-out, the family would need immediate access to other funds or might need to borrow additional funds at short notice and at unfavourable terms, just to make sure their loved one is buried timeously and in accordance with their final wishes and cultural preferences.

Recent changes to legislation have however directly impacted on how insurers are allowed to make payment of group funeral benefits. In terms of the Insurance Act, insurers are now only allowed to pay the group funeral lump sum benefit to a beneficiary nominated by the employee prior to his/her death and in the absence of such nomination, the lump sum must be paid to the employee’s estate.

This means that the employer must, at the employee’s death, supply the insurer with a valid nomination form in respect of the employee’s group funeral insurance before payment can be made. If there is no valid funeral beneficiary nomination form on record for the deceased employee, the insurer will unfortunately have no recourse but to pay the funeral lump sum benefit to the employee’s estate. This would however have undesirable consequences for the employee’s family as they will not be able to access the funeral benefit pay-out until the estate has been settled, which will most certainly not be in time to assist them with the payment of any funeral costs. All parties involved will agree that this would be a very unfortunate state of events and it is therefore extremely important that employers, and especially their employees, understand how these legislative changes impact payment of their group funeral benefits.

Given that the intention of funeral insurance is to assist the nominated beneficiary with the costs associated with arranging a funeral, there is an urgent need for employers, as the custodian of the group funeral policy, to ensure that all of their employees have completed valid beneficiary nomination forms in respect of their group funeral insurance. Even though this can be a very challenging exercise for many employers, the repercussions of not completing a nomination form are infinitely worse.

The sooner employees complete a separate nomination in respect of their funeral benefits (*), the easier they can rest in the knowledge that their nominated beneficiary will have immediate access to the benefit pay-out in the event of their death; and that is no small thing.

* Please note that other beneficiary nominations in respect of the employee’s group life and retirement fund benefits cannot be used for payment of their funeral benefit. Employees must therefore complete a separate nomination for their funeral benefit, in terms of the applicable legislation.

Sanlam has complied a member infographic that can be distributed to employees, in an effort to assist employers with this difficult but necessary task to create awareness around this important matter. To access Sanlam’s beneficiary nomination form templates (separate forms for funeral insurance and group life insurance), please click here to download the forms from the Sanlam website.