Previously, the Insurance Act allowed Insurance providers to pay the death benefit from Unapproved group life policies to the policyholder, typically the employer. The policyholder could then decide who receives the money. However, changes in the Insurance Act now only allows payment to beneficiaries nominated by the employee prior to their death. If no beneficiary is named or if the nomination is invalid, the benefit must be paid to the deceased member’s estate. The Act prohibits payments of death benefits to any other parties.

It’s important for Sanlam Corporate: Group Risk (SGR) members of Unapproved Group Life policies to complete a beneficiary nomination form. This ensures that loved ones and other dependents are not left financially vulnerable after the member’s passing. Dealing with the loss of a loved one is challenging, and any financial burden only adds to the strain. The Act also impacts the death of a member on a funeral benefit, as this can also only be paid to the deceased member’s nominated beneficiary. (Please note that separate nominations forms are required for Life and Funeral policies)

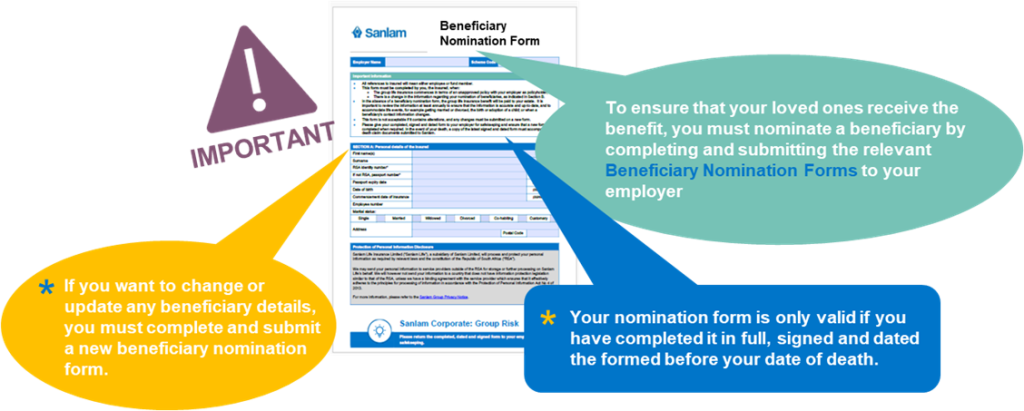

Completing the relevant beneficiary nomination forms, provides essential information for smooth and prompt pay-outs in the event of your death, preventing delays that could further burden your loved ones financially and emotionally. Remember, without a completed nomination form the money goes to the member’s estate, causing delays and leaving the family without the immediate funds they need.

By completing nomination forms in respect of your applicable benefits, you will have peace of mind that your intended beneficiaries will receive the payment in the shortest possible time, in the event of your death; and that is no small thing.

To access Sanlam’s beneficiary nomination forms (separate forms for funeral insurance and group life insurance), please click here to download the forms from the Sanlam website.

Bruno Correia