Michele Jennings confirmed in the recent Benchmark Symposium presentation that:

- For Sanlam Corporate: Group Risk (hereafter referred to as SGR), the true purpose of an insurer is to deliver on the promise made to clients to support them in their time of need; and

- SGR’s goal is sustainability for the long haul and not just one or two years through COVID. SGR is once again in the fortunate position of being an insurer with one of the highest levels of capital and reserves – with a Group Solvency Capital Requirement ratio of 242% Sanlam Life has sufficient reserves and capital to pay claims through these next COVID waves or the next crisis.

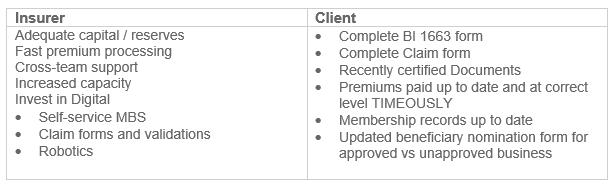

She concluded that, to ensure SGR delivers on their promise, and to pay claims quickly, the following is required:

- Operational changes need to be made, which will require a combination of adding resources and investing in digital – refer the list on the left (we are at varying stages and quality of finalizing).

- Getting the necessary information on submission of the claim – refer to the list on the right that our Claims team provided for guidance on the top few items they felt would reduce claim payment delays:

Michele reiterated that, as a result of the new Insurance Act of 2017, providing the valid beneficiary nomination form is important. Employers, insurers and intermediaries can no longer, under any circumstances, apply their discretion in determining the correct beneficiaries for unapproved business, which includes funeral business. This effectively meant that, in the absence of a beneficiary nomination form for unapproved business, even a funeral benefit, will be paid to the member’s estate.

Click here for more information