The Investment Committee is responsible to monitor the investment strategy, to ensure appropriate investment reporting to members, and to work with the Board’s appointed investment consultants to review the entire investment offering from time to time. This includes reviewing the trustee approved default strategies to identify possible improvements that may benefit members and refining the member investment choice menu to ensure available portfolios have performed in line with their mandates.

After consulting with the Fund’s appointed Investment Consultants and investigating various alternative solutions, a decision has been made to replace the SIM Cash Fund with the SIM Enhanced Cash Fund

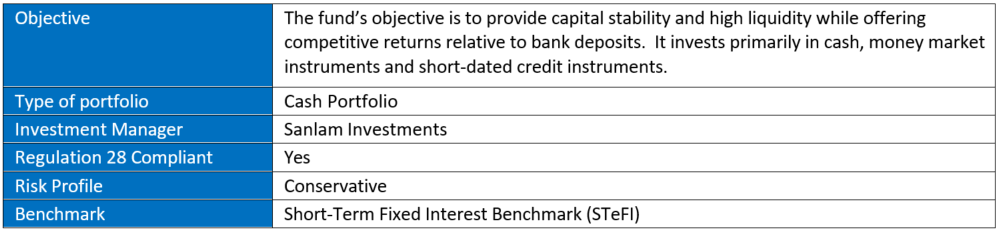

About the SIM Enhanced Cash Fund

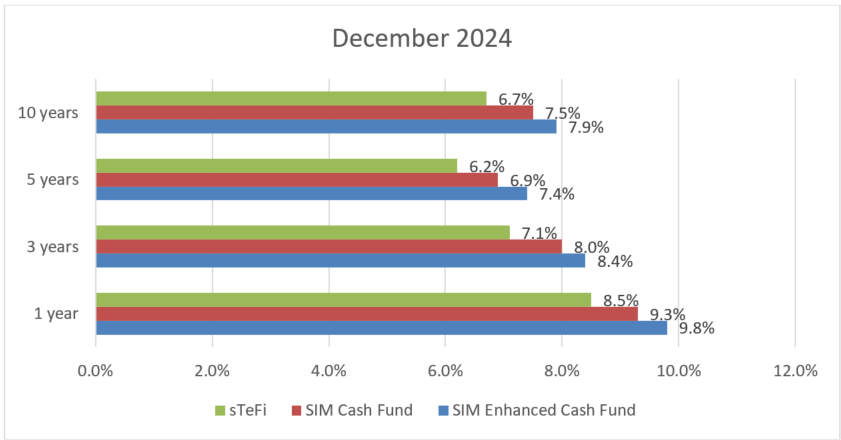

The key reason for this change: SIM Enhanced Cash has shown a better return profile than SIM Cash. The graph below shows that the SIM Enhanced Cash Fund has outperformed the SIM Cash Fund with 0.40% to 0.50% per annum over various time periods.

Over 10 years, SIM Enhanced Cash has outperformed SIM Cash on average by 0.45% p.a.

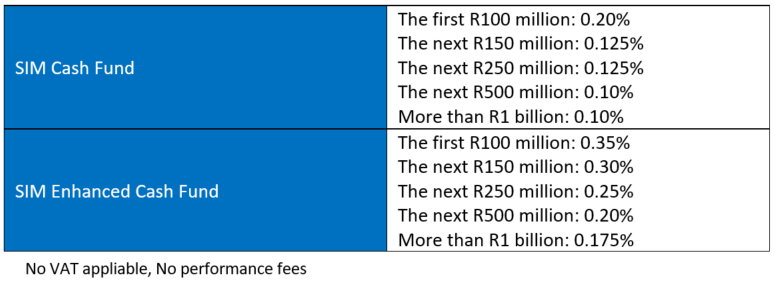

Investment Management Fees

The table below shows the difference in investment management fees between the two portfolios:

Although the SIM Enhanced Cash fees are higher than the SIM Cash Fund, members still benefit from the higher performance numbers.

Next Steps

Members invested in the SIM Cash Fund as a member choice option, will have an opportunity to select a new portfolio from the range of member investment choice portfolios on the Sanlam Umbrella Fund menu. If no alternative election is made, members’ fund values in the SIM Cash Fund will be switched to the SIM Enhanced Cash Fund in March 2025. Members have until 28 February 2025 to make an alternative selection.

Important to note is that during the period from 12 March until 25 March 2025, unit prices on the SIM Cash Fund and SIM Enhanced Cash Fund will not be released and as a result, there will be no member transacting during this period. That is, we are unable to update member contributions, pay member claims, or effect member switches for the impacted members invested in these portfolios.

The Sanlam Umbrella Fund offers a range of risk-profiled investment options ranging from passive, smoothed bonus, multi-managed and single manager balanced funds. Members may choose to invest in a maximum of four portfolios at a time and can switch between portfolios free of charge. Herewith a reminder of the available member choice portfolios in terms of potential risk versus return:

To make an alternative investment selection before or on 28 February 2025, please download the Sanlam Portfolio App or log onto the Member Portal. This app will provide effortless access to all your retirement information via any mobile device and allow you to switch your investments online. We encourage you to discuss this with your personal financial advisor before switching.

Please rest assured that the Sanlam Umbrella Fund’s aim is to ensure the continued effectiveness and suitability of the default investment strategies and member choice options offered to our clients. Should you have any queries in this regard, please contact your Contracted Benefit Consultant.